News

STAY UPDATED

Reinvigorating your company’s sales efforts heading into the new year

Reinvigorating your company’s sales efforts heading into the new year Business owners, with the...

Answers to your tax season questions

Answers to your tax season questions The IRS announced it will open the 2024 income tax return...

BMG Certified Public Accountants, LLP Celebrates

BMG Certified Public Accountants, LLP Celebrates 100 Years of Delivering Solutions to Tough...

A company car is a valuable perk but don’t forget about taxes

A company car is a valuable perk but don’t forget about taxes One of the most appreciated fringe...

Is your business underestimating the value of older workers?

Is your business underestimating the value of older workers? The job market remains relatively...

The “nanny tax” must be paid for nannies and other household workers

The “nanny tax” must be paid for nannies and other household workers You may have heard of the...

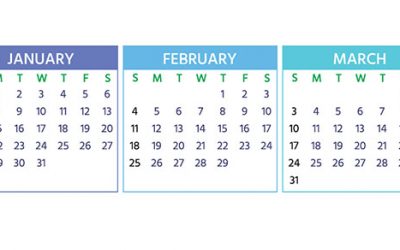

2024 Q1 tax calendar: Key deadlines for businesses and other employers

2024 Q1 tax calendar: Key deadlines for businesses and other employers Here are some of the key...

Smaller companies: Explore pooled employer plans for retirement benefits

Smaller companies: Explore pooled employer plans for retirement benefits Most businesses today...

11 Exceptions to the 10% penalty tax on early IRA withdrawals

11 Exceptions to the 10% penalty tax on early IRA withdrawals If you’re facing a serious cash...