News

STAY UPDATED

Are you a nonworking spouse? You may still be able to contribute to an IRA

Are you a nonworking spouse? You may still be able to contribute to an IRA Married couples may not...

Hiring your minor children this summer? Reap tax and nontax benefits

Hiring your minor children this summer? Reap tax and nontax benefits If you’re a business owner...

The long and short of succession planning

The long and short of succession planning For many business owners, putting together a succession...

Seniors may be able to write off Medicare premiums on their tax returns

Seniors may be able to write off Medicare premiums on their tax returns Are you age 65 and older...

Recordkeeping DOs and DON’Ts for business meal and vehicle expenses

Recordkeeping DOs and DON’Ts for business meal and vehicle expenses If you’re claiming deductions...

Tax-favored ways to build up a college fund

Tax-favored ways to build up a college fund If you’re a parent with a college-bound child, you may...

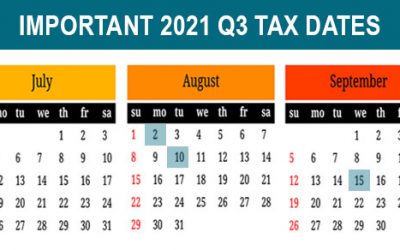

2021 Q3 tax calendar: Key deadlines for businesses and other employers

2021 Q3 tax calendar: Key deadlines for businesses and other employers Here are some of the key...

Retiring soon? 4 tax issues you may face

Retiring soon? 4 tax issues you may face If you’re getting ready to retire, you’ll soon experience...

The IRS has announced 2022 amounts for Health Savings Accounts

The IRS has announced 2022 amounts for Health Savings Accounts The IRS recently released guidance...