News

STAY UPDATED

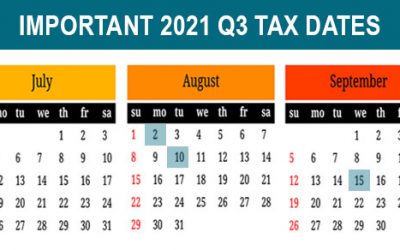

2021 Q3 tax calendar: Key deadlines for businesses and other employers

2021 Q3 tax calendar: Key deadlines for businesses and other employers Here are some of the key...

Retiring soon? 4 tax issues you may face

Retiring soon? 4 tax issues you may face If you’re getting ready to retire, you’ll soon experience...

The IRS has announced 2022 amounts for Health Savings Accounts

The IRS has announced 2022 amounts for Health Savings Accounts The IRS recently released guidance...

Plan ahead for the 3.8% Net Investment Income Tax

Plan ahead for the 3.8% Net Investment Income Tax High-income taxpayers face a 3.8% net investment...

An S corporation could cut your self-employment tax

An S corporation could cut your self-employment tax If your business is organized as a sole...

Help ensure the IRS doesn’t reclassify independent contractors as employees

Help ensure the IRS doesn’t reclassify independent contractors as employees Many businesses use...

Are you ready for the return of trade shows and other events?

Are you ready for the return of trade shows and other events? It’s happening. With vaccination...

Providing education assistance to employees? Follow these rules

Providing education assistance to employees? Follow these rules Many businesses provide education...

Getting max value out of your CRM software

Getting max value out of your CRM software The days of the Rolodex are long gone. To connect with...