by Sarah Boehle Pool | Jan 10, 2024 | Latest News

The “nanny tax” must be paid for nannies and other household workers You may have heard of the “nanny tax.” But if you don’t employ a nanny, you may think it doesn’t apply to you. Check again. Hiring a housekeeper, gardener or other household employee (who isn’t an...

by Sarah Boehle Pool | Jan 8, 2024 | Latest News

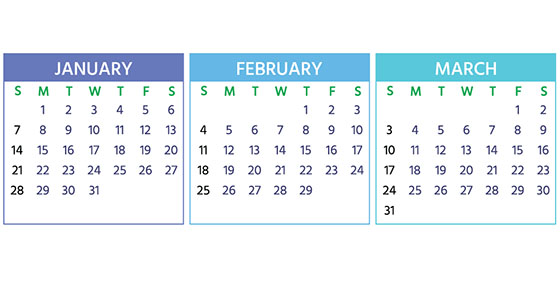

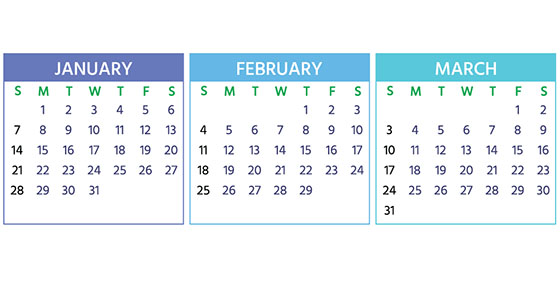

2024 Q1 tax calendar: Key deadlines for businesses and other employers Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional...

by Sarah Boehle Pool | Dec 28, 2023 | Latest News

Smaller companies: Explore pooled employer plans for retirement benefits Most businesses today need to offer a solid benefits package. Failing to do so could mean falling behind in the competition to hire and retain talent in today’s tight job market. When it comes to...

by Sarah Boehle Pool | Dec 27, 2023 | Latest News

11 Exceptions to the 10% penalty tax on early IRA withdrawals If you’re facing a serious cash shortfall, one possible solution is to take an early withdrawal from your traditional IRA. That means one before you’ve reached age 59½. For this purpose, traditional IRAs...

by Sarah Boehle Pool | Dec 21, 2023 | Latest News

Some businesses may have an easier path to financial statements There’s no getting around the fact that accurate financial statements are imperative for every business. Publicly held companies are required to not only issue them, but also have them audited by an...

by Sarah Boehle Pool | Dec 20, 2023 | Latest News

What you need to know about restricted stock awards and taxes Restricted stock awards are a popular way for companies to offer equity-oriented executive compensation. Some businesses offer them instead of stock option awards. The reason: Options can lose most or all...