by Sarah Boehle Pool | Aug 16, 2021 | Latest News

Hiring your minor children this summer? Reap tax and nontax benefits If you’re a business owner and you hire your children this summer, you can obtain tax breaks and other nontax benefits. The kids can gain on-the-job experience, spend time with you, save for college...

by Sarah Boehle Pool | Aug 12, 2021 | Latest News

The long and short of succession planning For many business owners, putting together a succession plan may seem like an overwhelming task. It might even seem unnecessary for those who are relatively young and have no intention of giving up ownership anytime soon. But...

by Sarah Boehle Pool | Aug 11, 2021 | Latest News

Seniors may be able to write off Medicare premiums on their tax returns Are you age 65 and older and have basic Medicare insurance? You may need to pay additional premiums to get the level of coverage you want. The premiums can be expensive, especially if you’re...

by Sarah Boehle Pool | Aug 9, 2021 | Latest News

Recordkeeping DOs and DON’Ts for business meal and vehicle expenses If you’re claiming deductions for business meals or auto expenses, expect the IRS to closely review them. In some cases, taxpayers have incomplete documentation or try to create records months (or...

by Sarah Boehle Pool | Aug 4, 2021 | Latest News

Tax-favored ways to build up a college fund If you’re a parent with a college-bound child, you may be concerned about being able to fund future tuition and other higher education costs. You want to take maximum advantage of tax benefits to minimize your expenses. Here...

by Sarah Boehle Pool | Aug 2, 2021 | Latest News

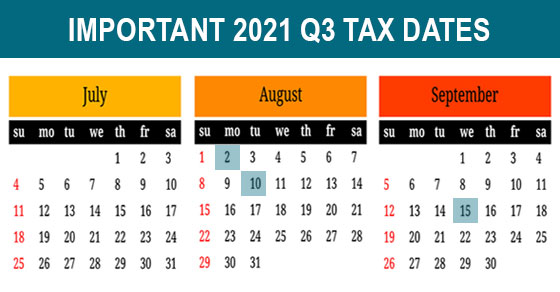

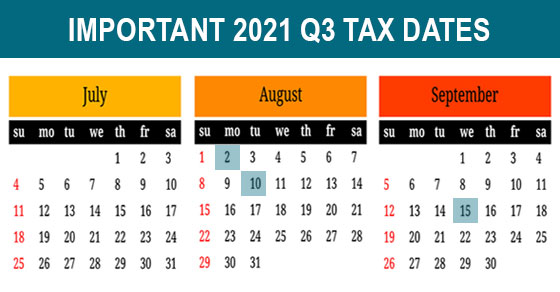

2021 Q3 tax calendar: Key deadlines for businesses and other employers Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2021. Keep in mind that this list isn’t all-inclusive, so there may be additional...